Best Life Insurance for Heart Patients (2023)

If you have a heart condition, you may wonder if you can get life insurance coverage. The answer is yes, but finding the best life insurance for heart patients can be more challenging.

In this article, we will explore the best life insurance for heart patients, the types of heart conditions that affect life insurance approval, the types of life insurance policies available, and the application process for heart patients.

People with heart conditions may face higher premiums or limited coverage options when finding life insurance coverage.

However, several insurance companies specialize in providing coverage to people with pre-existing conditions like heart disease.

By understanding the different types of policies available and the application process, you can improve your chances of finding the right coverage at a reasonable price.

Key Takeaways

- You can get life insurance if you have a heart condition but it depends on the severity of the condition as to how much you will pay.

- Lincoln Financial, Prudential, and Protective offer some of the best options for getting the best life insurance for heart patients.

- Term life insurance is going to be your best option for affordable coverage.

Table of Contents

Can You Get Life Insurance with a Heart Condition

Yes, you can qualify for life insurance if you have a heart condition. Many insurance companies offer coverage to people with heart conditions, although the cost and the amount of coverage you can get may depend on the severity of your condition.

When you apply for life insurance, the insurance company will ask you questions about your medical history, including any heart conditions you have.

They may also require you to undergo a medical exam to evaluate your overall health and assess your risk. Based on this information, the insurance company will determine whether to offer you coverage and how much to charge.

You may qualify for standard life insurance rates if you have a mild or moderate heart condition, such as high blood pressure or high cholesterol.

However, you may be considered a higher risk if you have a more severe condition, such as a history of heart attacks or heart failure. You may have to pay higher premiums or be limited in the coverage you can get.

Shop around and compare quotes from multiple insurance companies to find the best coverage and rates for your situation. Working with an independent insurance agent can also help you navigate the process and find the right policy for your needs.

Best Life Insurance Companies for Heart Patients

You may be worried about getting life insurance if you have a heart condition. However, several life insurance companies offer policies to people with heart conditions.

Here are some of the best life insurance companies for heart patients:

- Lincoln Financial: Lincoln Financial offers a variety of life insurance policies, including term life insurance, universal life insurance, and variable universal life insurance. Their underwriting team specializes in high-risk cases, including heart conditions.

- Prudential: Prudential is another excellent option for heart patients. They offer term life insurance, universal life insurance, and variable universal life insurance. Their underwriting team specializes in high-risk cases, including heart conditions.

- Protective: Protective is known for offering affordable life insurance policies to people with pre-existing conditions. They have several policies that may be suitable for heart patients, including term life insurance and universal life insurance.

3 Things You Can Do To Improve Your Chances of Getting the Best Life Insurance for Heart Patients

There are several things you can do to improve your chances of getting approved for the best life insurance for heart patients. These include:

- Getting your condition under control: If you have high blood pressure or cholesterol, managing these conditions can improve your chances of getting approved for life insurance.

- Providing detailed medical records: Providing detailed medical records can help the underwriter understand the severity of your condition and make a more accurate assessment of your risk.

- Being honest about your condition: When applying for life insurance, it’s essential to be honest about your situation. If you’re honest, the insurance company may only accept your claim in the present.

Types of Heart Conditions and How They Affect Life Insurance Approval

When it comes to getting life insurance with a heart condition, your type of heart condition will play a significant role in whether you can get coverage and how much you will pay for it.

Different heart conditions carry different levels of risk, which is why insurance companies will ask you about your specific condition when you apply for coverage.

Here are some common types of heart conditions and how they can affect your ability to get life insurance:

- Coronary artery disease (CAD) is when plaque builds up in the arteries that supply blood to the heart. If you have CAD, you may have difficulty getting life insurance, especially if you have a history of heart attacks or have had heart surgery.

- Arrhythmia: This refers to an irregular heartbeat. You can get life insurance at a standard rate if you have a mild arrhythmia that is well-controlled with medication. However, if your arrhythmia is severe or has caused complications, you may have difficulty obtaining coverage.

- Heart valve disease is when one or more of the heart’s valves don’t work correctly. You can get life insurance at a standard rate if you have mild valve disease. However, if your valve disease is severe or has caused complications, you may have difficulty obtaining coverage.

- Congestive heart failure (CHF): This is a condition where the heart can’t pump enough blood to meet the body’s needs. If you have CHF, you may have difficulty getting life insurance, especially if your condition is severe or you have a history of hospitalizations.

- Hypertension: This is another name for high blood pressure. You can get life insurance at a standard rate if you have mild hypertension that is well-controlled with medication. However, you may have difficulty obtaining coverage if your hypertension is severe or has caused complications.

In addition to your heart condition, insurance companies will also consider other factors when determining your eligibility for coverage, such as

- Your age

- Smoking status

- Blood pressure

- Cholesterol levels

- Overall health

- Medical history

- Unhealthy habits, such as a poor diet or lack of exercise

It’s important to note that making lifestyle changes, such as quitting smoking or losing weight, can help improve your chances of getting approved for life insurance and may even lower your premiums.

If you have a heart condition, talk to your doctor about improving your overall health and reducing your risk of complications.

Types of Life Insurance Policies Available with Heart Conditions

If you have a heart condition and are looking for life insurance coverage, you may wonder what types of policies are available.

Here are some of the most common types of life insurance policies that you can consider:

Term Life Insurance

Term life insurance is a policy that provides coverage for a set period, usually between 10 and 30 years.

This policy is often the most affordable option for people with heart conditions, as it provides coverage for a limited time and does not accumulate cash value.

Option #1 You can add a return of premium rider to the policy to the policy and if you don’t claim on the policy after the term is up you can be paid back all premiums.

Option #2 Most term life policies offer a paid-up policy option once the term is up as well. This will typically be a reduced death benefit with no additional premiums.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of your life as long as you continue to pay your premiums.

This type of policy can be more expensive than term life insurance, but it provides more comprehensive coverage and accumulates cash value over time.

Even though this type of policy does offer a cash value it is important to note that if you do take money from it you will have to pay it back.

Whole life insurance is my least favorite option because of this restriction.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that provides coverage for your entire life but offers more flexibility than whole life insurance.

With a universal life insurance policy, you can adjust your premiums and death benefits as your needs change.

For example, if you have a sizable amount of money in your cash value and you can’t afford to make a payment one month it will automatically withdraw it from the cash value.

If you get enough money built up in the cash value the policy may be able to survive on the cash value alone, but it’s recommended to talk to a licensed life insurance before considering this option.

There are 3 types of universal life insurance policies.

- Fixed Universal Life – The cash value earns a fixed return and will not lose money.

- Indexed Universal Life – The cash value is invested in an index fund and is less risky than a variable account.

- Variable Universal Life – The cash value is invested in the stock market and earns higher returns but can also lose money if returns fall.

Guaranteed Issue Life Insurance

Guaranteed-issue life insurance is available to people with pre-existing conditions, including heart conditions.

This type of policy does not require a medical exam or health questionnaire, but it may have higher premiums and lower death benefits than other policies.

Guaranteed issue life insurance does not carry Day One Benefits. Most policies like this will not pay out the full death benefit once the policy has been enforced for two full years.

This would be my last option to consider when looking for the best life insurance for heart patients.

Chris’s Thoughts

I personally recommend term life as a first option because it’s going to be much cheaper than all the other options. Universal life is a good second option but will be much more expensive than term if you qualify. Finally, if all else fails look at guaranteed issue life insurance as a last option.

The Application Process with Heart Patients

If you have a heart condition, applying for life insurance can be more challenging than for those who don’t. But that doesn’t mean it’s impossible. Many life insurance companies offer coverage for people with heart conditions. Some even specialize.

When you apply for life insurance, you must provide detailed medical records, including any history of heart disease or related conditions. Underwriters use this information to assess your risk level and determine your premium.

Life insurance table ratings allow insurers to take additional risk factors into account when setting a policy premium.

According to Insurance.com, table ratings represent an insured’s excess risk to a life insurer due to health issues, professions, and avocations.

When applying for life insurance, being honest and upfront about your medical history is important.

If you have a heart condition, you must provide detailed medical records and be prepared to answer questions about your condition.

Way To Improve Your Chances of Getting Life Insurance with a Heart Conditions

If you have a heart condition, it can be challenging to get life insurance. However, you can take steps to improve your chances of getting coverage. Here are some tips to help you:

- Get your condition under control: The better you manage your heart condition, the more likely you will get life insurance. Ensure you take your medications as prescribed and follow your doctor’s advice. Keep track of your symptoms and report any changes to your doctor promptly.

- Quit smoking: If you smoke, quitting can improve your chances of getting life insurance. Smoking increases your risk of heart disease, so stopping it can help lower your risk and improve your overall health.

- Maintain a healthy weight: Being overweight or obese can increase your risk of heart disease. If you are overweight, losing weight can help improve your health and increase your chances of getting life insurance.

- Stay active: Regular exercise can help improve your heart health and lower your risk of heart disease. Aim for at least 30 minutes of moderate-intensity exercise most days of the week.

- Consider a term life insurance policy: If you have a heart condition, a term life insurance policy may be easier to qualify than a permanent one. Term policies provide coverage for a specific period, such as 10 or 30 years, and are generally less expensive than permanent policies.

- Shop around: Different insurance companies have different underwriting guidelines, so it’s worth shopping around to find a company specializing in insuring people with heart conditions.

Remember that each insurance company has different underwriting guidelines, so shopping around and comparing policies is essential to finding the best life insurance for heart patients.

What is the Best Life Insurance for Heart Patients

So how much could you expect to pay? Insurance rates and premiums vary widely depending on various factors.

These factors include the severity of the heart condition, age, gender, and overall health. Generally speaking, the more severe the heart condition, the higher the insurance rates and premiums.

In addition to the severity of the heart condition, insurance rates and premiums are also affected by the type of policy you choose.

For example, term life insurance policies tend to have lower premiums than permanent life insurance policies. This is because term policies only provide coverage for a specific period, while permanent policies provide coverage for the rest of your life.

Another factor that can affect insurance rates and premiums is your overall health. If you have other health conditions besides your heart condition, this can increase your rates and premiums.

On the other hand, if you have a healthy lifestyle and no other health conditions, you may qualify for lower rates and premiums.

It’s also important to note that insurance rates and premiums vary widely between insurance companies.

This is why shopping around and comparing rates and premiums from multiple insurance providers is essential. Doing so lets you find the best life insurance for heart patients.

So what could you expect to pay? Below I’ll give you a few examples.

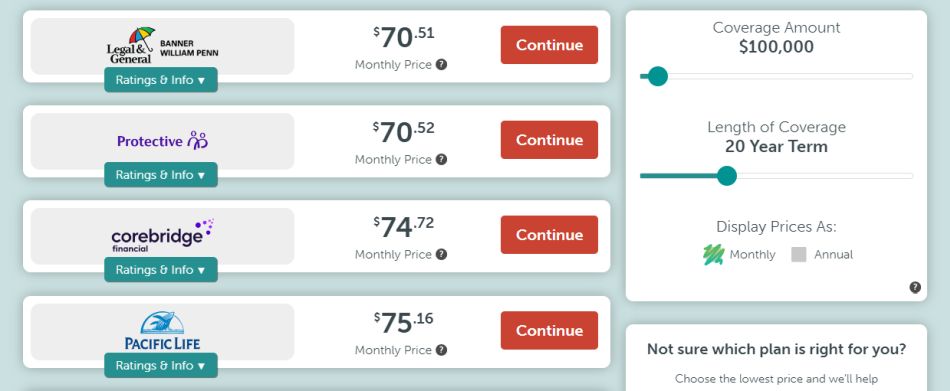

The first group of rates is for a male who has high blood pressure at 140/90, and high cholesterol, at age 60, looking for a 20-year term life policy with $100,000 in coverage.

As you can see you’re looking at $70 to $75 a month for a $100,000 of coverage. For a man at age 60 with some hypertension, this is fairly reasonable.

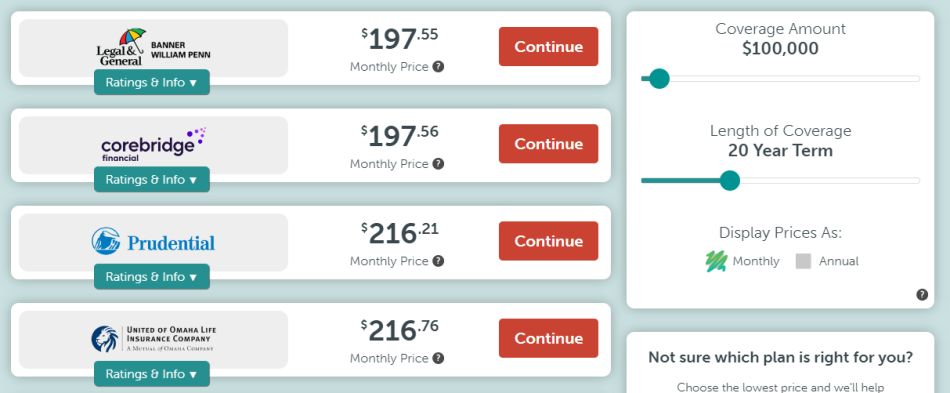

Now let’s see how the same situation would look for the same person with bad health conditions, a smoker, and a family history of heart problems.

The price jumps from $70 a month to $197 a month for the same $100,000 in coverage. So take care of yourself, eat healthy, stop smoking, and get your health under control if you want to save on paying high life insurance premiums.

Frequently Asked Questions

What is the best life insurance for people with heart problems?

The best life insurance for heart patients depends on the individual’s medical history and current condition. Shopping around and comparing quotes from multiple insurance providers is recommended to find the best policy that fits your specific needs.

Can I get life insurance for a heart condition?

Yes, it is possible to get life insurance with a heart condition. However, the premiums may be higher, and the coverage may be limited, depending on the severity of the condition. Working with an experienced insurance agent who can help you find the best life insurance for heart patients is recommended.

Can a person with congestive heart failure get life insurance?

A person with congestive heart failure can get life insurance, but it may be more difficult to obtain coverage and the premiums may be higher. Working with an experienced insurance agent who can help you find the best policy for your needs is recommended.

How long after a heart attack can you get life insurance?

The time frame after a heart attack to obtain life insurance varies depending on the insurance company and the severity of the heart attack. Generally, most insurance companies require a waiting period of 6 months to a year after a heart attack before considering providing coverage. However, working with an experienced insurance agent who can help you find the best policy for your needs is recommended.

What are the options for life insurance after a stent procedure?

After a stent procedure, it is possible to obtain life insurance, but the premiums may be higher, and the coverage may be limited. Working with an experienced insurance agent who can help you find the best policy for your needs is recommended.

Which insurance companies offer life insurance for individuals with heart conditions?

Several insurance companies offer life insurance for individuals with heart conditions, including MetLife, Prudential, AIG, and Mutual of Omaha. Working with an experienced insurance agent who can help you find the best policy for your needs is recommended.

Best Life Insurance Options with Other Health Conditions

Are you dealing with other health conditions? Here is a list of articles to check out.

![What is the Average Life Insurance Cost Per Month [Includes Rate Charts]](https://walletimpact.com/wp-content/uploads/2020/07/Average-Life-Insurance-Rates-768x432.jpg)