Debt Avalanche vs Debt Snowball Method: Which Saves More?

Are you looking for a way to pay off your debt faster? Maybe you heard of the debt snowball and the debt avalanche plan? However, you might be thinking which one will pay off your debt faster and save you more.

The debt avalanche method saves more money and pays off debt faster by targeting high-interest debts first, saving you hundreds or thousands in interest payments compared to the snowball approach. However, the debt snowball method might get you debt-free faster in practice if its psychological wins keep you motivated and prevent you from giving up halfway through your journey.

Over the years, I’ve paid off my fair share of debt and found that both of these plans can be very successful. So let’s take a deeper look and see which one is right for you.

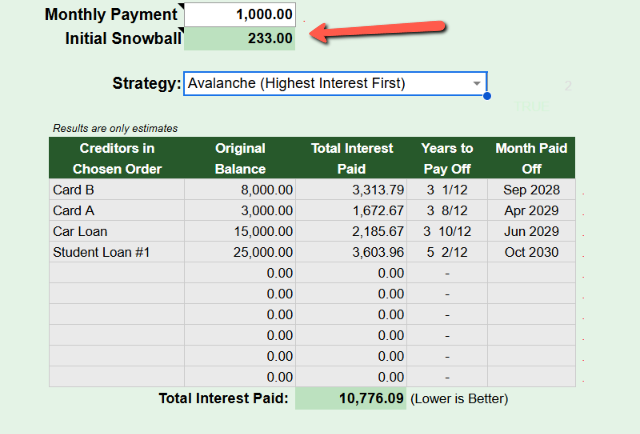

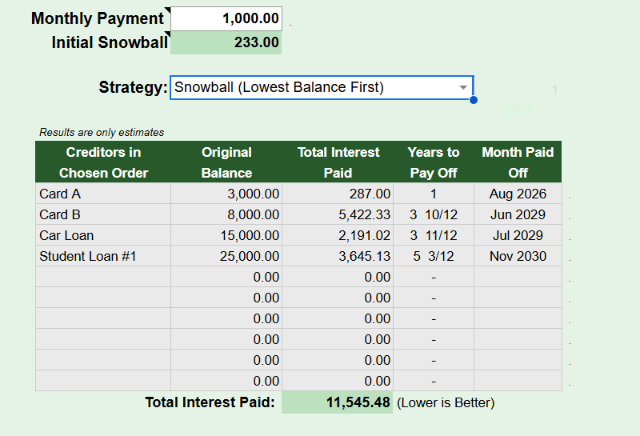

Download this free debt reduction spreadsheet from Vertex 42. You can input your debts into the spreadsheet and test out different sceniros to see how much and how fast you could pay off your debts.

What Is the Debt Avalanche Method?

Let’s start with the debt avalanche method – the mathematician’s favorite approach to debt repayment.

Think of it like this: imagine you’re standing at the base of a mountain made entirely of your debts. The debt avalanche method says, “Hey, let’s tackle the steepest, most dangerous part first,” which translates to paying off your highest-interest debt before anything else.

Here’s how it works:

- List all your debts from the highest to the lowest interest rate

- Make minimum payments on the lowest interest debts

- Throw every extra dollar at the debt with the highest interest rate

- Once that’s paid off, move to the next highest rate

- Repeat until debt-free

For example, let’s say you have:

- Credit Card A: $3,000 at 18% APR

- Credit Card B: $8,000 at 24% APR ← Start here

- Car Loan: $15,000 at 7% APR

- Student Loan: $25,000 at 4% APR

With the avalanche method, you’d focus all your extra payments on Credit Card B first, even though Credit Card A has a lower balance, because that 24% interest rate is eating you alive faster than a pack of hungry wolves.

With this plan, you will pay $10,766 in interest and pay off the debt by October 2030, or 5 years and 2 months if you apply an extra $233, rounding out your payment to $1000 a month.

What Is the Debt Snowball Method?

Now, let’s discuss the debt snowball method – the psychology enthusiast’s approach to getting out of debt.

Picture rolling a tiny snowball down a hill. It starts small, but as it gains momentum, it grows larger and larger until it becomes an unstoppable force. That’s exactly how this method works with your debts.

The debt snowball method says, “Forget the math for a second – let’s focus on quick wins that keep you motivated.”

Here’s the game plan:

- List all your debts from smallest to largest balance (ignore interest rates)

- Make minimum payments on the higher balance debts

- Attack the smallest debt with all your extra money

- Celebrate when it’s gone, then roll that payment into the next smallest debt

- Keep the momentum rolling until you’re debt-free

Using our same example:

- Credit Card A: $3,000 at 18% APR ← Start here

- Credit Card B: $8,000 at 24% APR

- Car Loan: $15,000 at 7% APR

- Student Loan: $25,000 at 4% APR

You’d still start with Credit Card A, but purely because of its $3,000 balance, not the interest rate. The psychological boost of eliminating that first debt entirely? That’s pure gold for your motivation.

With this plan, you will pay $11,545 in interest and pay off the debt by November 2030, or 5 years and 3 months if you apply an extra $233, rounding out your payment to $1000 a month.

Debt Avalanche vs Debt Snowball: The Head-to-Head Comparison

Alright, let’s put these two heavy hitters in the ring and see how they stack up across the categories that matter to you.

Money Savings: The Math Champion

Winner: Debt Avalanche

When it comes to cold, hard cash savings, the debt avalanche method wins hands down. By targeting high-interest debt first, you’re essentially plugging the biggest holes in your financial boat.

Let’s crunch some numbers. Say you have $5100 in total debt and can put an extra $233 monthly toward debt repayment:

| Method | Total Interest Paid | Time to Pay Off |

|---|---|---|

| Debt Avalanche | $10,766 | 5 years, 2 months |

| Debt Snowball | $11,545 | 5 years, 3 months |

That’s a difference of $779 – enough for a nice vacation when you’re debt-free!

Motivation and Psychology: The Feel-Good Factor

Winner: Debt Snowball

Here’s where the debt snowball method shines brighter than a diamond. There’s something incredibly powerful about eliminating a debt, even if it’s small. It’s like crossing items off your to-do list – pure dopamine.

Research shows that people using the snowball method are more likely to stick with their debt repayment plan. Why? Because early wins create momentum. Each paid-off debt is a victory lap that keeps you motivated for the long haul.

Think about it: would you rather save a theoretical $1,700 over four years, or feel the rush of knocking out three debts in your first year? For many people, the psychological boost trumps the mathematical advantage.

Time to Debt Freedom

Winner: Debt Avalanche (Usually)

The avalanche method typically gets you out of debt faster because you’re not letting high-interest debt compound as long. However, the difference is often just a few months – not exactly life-changing.

The real kicker? If the snowball method keeps you more motivated and prevents you from giving up halfway through, it might get you to the finish line faster in practice.

Which Method Helps Pay Off Debt Faster?

This is where things get interesting. On paper, the debt avalanche method wins the speed race almost every time. By attacking high-interest debt first, you’re preventing that interest from snowballing (pun intended) out of control.

But here’s the plot twist: the best method is the one you stick with.

I’ve seen too many people start with the mathematically superior avalanche method, only to give up after six months because they felt like they weren’t making progress. Meanwhile, their friend, using the snowball method, stayed motivated, paid off five smaller debts, and built unstoppable momentum.

Speed isn’t just about math – it’s about human behavior. And humans are beautifully, frustratingly irrational creatures.

Is the Debt Snowball Method Better for Motivation?

Absolutely, yes. The debt snowball method is like having a personal cheerleader for your finances.

Here’s why it works so well psychologically:

- Quick wins boost confidence: Paying off that first debt completely feels amazing

- Visible progress: Your debt list gets shorter

- Simplified focus: Fewer moving pieces to track and manage

- Momentum building: Each success makes the next one easier

Dave Ramsey, the king of debt snowball advocacy, puts it perfectly: “Personal finance is 20% head knowledge and 80% behavior.” The snowball method recognizes that our emotions play a huge role in financial success.

If you’re someone who thrives on positive reinforcement, gets discouraged easily, or has tried and failed at debt repayment before, the snowball method might be your ticket to success.

Apps and Tools to Supercharge Your Debt Repayment

Let’s be real – keeping track of multiple debts, payment schedules, and progress can feel like juggling flaming torches while riding a unicycle. Thankfully, there are some incredible tools to make this journey easier.

Top Free Tools:

Undebt.it: This web-based tool is like having a financial advisor in your pocket. You can model both avalanche and snowball approaches, see visual progress charts, and even play “what if” scenarios with extra payments.

Ramsey Snowball Calculator: If you’re team snowball, this free tool from Dave Ramsey’s team creates a step-by-step payoff plan with exact dates and amounts.

Unbury.me: Simple, clean interface that shows you exactly how much you’ll save with different strategies. Perfect for the visually motivated.

Premium Options Worth Considering:

YNAB (You Need a Budget): While primarily a budgeting app, YNAB’s debt tools are phenomenal. It helps you find extra money in your budget to throw at debt while tracking your progress.

Bright Money: This AI-powered app actually analyzes your spending patterns and automates payments for maximum efficiency. It’s like having a robot financial advisor.

Debt Payoff Planner: Available on iOS and Android, this app lets you track multiple strategies simultaneously and switch between them as your situation changes.

| Tool | Platform | Best For | Price |

|---|---|---|---|

| Undebt.it | Web | Visual learners | Free |

| YNAB | All platforms | Budget integration | $15/month or $109/year |

| Bright Money | Mobile | Automation lovers | Free to $97/year |

| Ramsey Calculator | Web | Snowball enthusiasts | Free |

Can You Switch Between Methods?

Here’s a secret the financial gurus don’t always tell you: you’re not married to one method forever.

Life changes, and so can your debt strategy. Maybe you start with the snowball method to build confidence, then switch to avalanche once you’ve knocked out a few debts. Or perhaps you begin with an avalanche but find yourself losing motivation and need the psychological boost of some quick wins.

I’ve seen people successfully use hybrid approaches, like:

- Modified snowball: Target the smallest balances, but prioritize any debt over 20% interest first

- Avalanche with exceptions: Focus on high-interest debt, but knock out any balance under $500 immediately

- Seasonal switching: Use snowball during stressful periods, avalanche when you’re feeling disciplined

The key is being honest about what motivates you and adjusting accordingly. Flexibility isn’t failure – it’s a smart strategy.

What Kind of Debt Works Best with Each Method?

Not all debt is created equal, and the type of debt you’re dealing with can influence which method works better.

Debt Avalanche Shines With:

- High-interest credit cards (18%+ APR)

- Payday loans (insanely high rates)

- Personal loans with variable rates

- Any debt over 10% interest

Debt Snowball Excels With:

- Multiple credit cards with similar rates

- Medical debt (often 0% interest)

- Mix of small and large balances

- Situations where you need motivation

Credit Card Debt Specifically:

Both methods work excellently for credit card debt, but here’s my take: if you have multiple cards with drastically different interest rates (say, one at 12% and another at 28%), go avalanche.

If your rates are all in the same ballpark (15-22%), the snowball method’s motivation boost might serve you better.

Common Mistakes That Derail Both Methods

I’ve seen smart, well-intentioned people crash and burn with both strategies. Here are the landmines to avoid:

Avalanche Method Mistakes:

- Ignoring the psychological game: Getting discouraged because progress feels slow

- Not celebrating small wins: Forgetting to acknowledge interest saved

- Analysis paralysis: Spending too much time calculating instead of acting

Snowball Method Mistakes:

- Ignoring interest completely: Not considering refinancing high-rate debt first

- Going too small: Starting with $50 balances instead of meaningful debts

- Lifestyle inflation: Using paid-off minimums to justify more spending

Universal Mistakes:

- Not having an emergency fund: One unexpected expense derails everything

- Continuing to use credit cards: Adding debt while trying to pay it off

- Not addressing spending habits: Treating symptoms instead of the disease

- Going it alone: Not involving your partner or support system

How to Choose the Right Method for YOU

Alright, decision time. Here’s my foolproof framework for choosing between debt avalanche and debt snowball:

Choose Debt Avalanche If:

- You’re naturally disciplined and patient

- You love spreadsheets and data

- The interest savings motivate you more than quick wins

- Your highest-interest debt has a reasonable balance

- You’ve completed long-term financial goals before

Choose Debt Snowball If:

- You get motivated by visible progress

- You’ve tried and failed at debt repayment before

- You have several small debts you could knock out quickly

- You’re feeling overwhelmed by your debt situation

- You respond well to positive reinforcement

Consider a Hybrid If:

- You have both very high-interest debt AND small balances

- You want the best of both worlds

- Your situation is complex, with different types of debt

The Credit Score Question

One question I get constantly: “Will using avalanche or snowball hurt my credit score?”

Here’s the good news: both methods will likely improve your credit score over time. Here’s why:

- Payment history (35% of your score): Making consistent minimum payments helps

- Credit utilization (30% of your score): Paying down balances lowers this ratio

- Length of credit history: Don’t close accounts once paid off (usually)

The debt avalanche method might improve your credit utilization ratio slightly faster since you’re targeting high-balance debts first. But honestly, the difference is minimal – both approaches lead to the same destination: paid-off debt and better credit.

Insert image of credit score improvement chart over time here

Staying Motivated for the Long Haul

Let’s talk about the elephant in the room: debt repayment is hard. It’s not just about math or psychology – it’s about maintaining discipline over months or years while life throws curveballs at you.

Here are my battle-tested strategies for staying motivated:

Track Everything:

Use apps, spreadsheets, or even a simple notebook. Seeing progress, no matter how small, keeps you going.

Celebrate Milestones:

Paid off 25% of your debt? Treat yourself (within budget). Eliminated your first credit card? Do a happy dance. You’ve earned it.

Find Your Why:

Want to buy a house? Take a dream vacation? Retire early? Keep your “why” visible and top-of-mind.

Build a Support System:

Share your goals with family, friends, or online communities. Accountability partners make all the difference.

Automate What You Can:

Set up automatic payments so you don’t have to rely on willpower every month.

Should You Consolidate First?

Before diving into either method, consider whether debt consolidation makes sense for your situation.

Consolidation might be smart if you:

- Have multiple high-interest debts (18%+ APR)

- Can qualify for a lower-interest personal loan or balance transfer card

- Want to simplify your payments

- Are overwhelmed by multiple due dates and minimum payments

However, consolidation isn’t magic. You still need a solid repayment strategy – it just gives you better terms to work with.

Warning signs consolidation isn’t right:

- You can’t qualify for better interest rates

- You’re tempted to run up the cards you just paid off

- The fees outweigh the benefits

- You’re using it to avoid addressing spending problems

The Bottom Line: Your Debt Freedom Journey Starts Now

Here’s what I want you to remember: the best debt repayment method is the one you use consistently.

You could have the most mathematically perfect strategy in the world, but if you abandon it after three months, it’s worthless. On the other hand, a “suboptimal” method that you stick with for two years will get you to debt freedom.

Both the debt avalanche and debt snowball methods work. They’ve helped millions of people escape debt and build better financial futures. The question isn’t which method is objectively better – it’s which one fits your personality, situation, and goals.

My advice? Start somewhere, start today. Pick the method that excites you more (yes, getting excited about debt repayment is normal), download one of those apps I mentioned, and make your first extra payment this week.

You’ve got this. Debt might feel overwhelming right now, but every financial success story starts with a single step. Whether you’re team avalanche or team snowball, the most important thing is that you’re ready to take action.

Your debt-free future is waiting. Which path will you choose to get there?

Ready to start your debt repayment journey? Try one of the recommended apps mentioned in this guide, or create a simple spreadsheet listing all your debts. The perfect time to start was yesterday – the second-best time is right now.