Emergency Fund vs Pay Off Debt – Which Comes First?

One issue I dealt with early on with my finances was whether to build up an emergency fund or pay off my debts first. In one case, it’s great to have the extra money set aside, but in the other case, it feels great to have a debt paid off. So what is the best answer?

It’s usually best to build a small emergency fund of at least $1000 first to protect you from surprise expenses, then focus on paying off high-interest debt as quickly as possible. This way, you avoid falling further into debt if an emergency comes up.

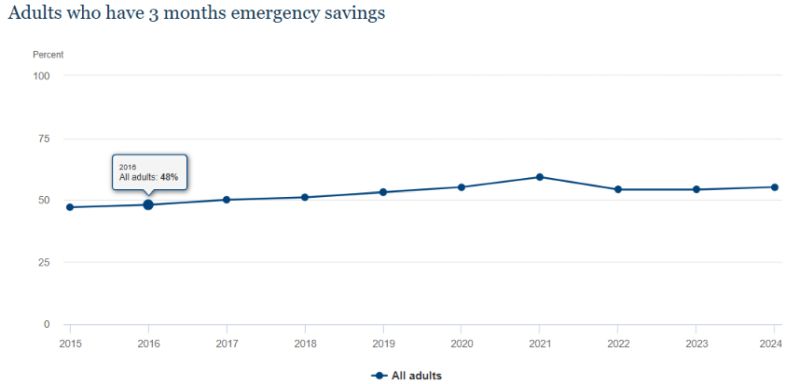

I find that an emergency fund is what helps me sleep at night, knowing that if an issue does come up, I have money to deal with it. According to the Federal Reserve, 55% of adults in 2024 have 3 months of emergency savings.

This is great for those who have saved this, but if you’re just getting started, it can leave you with some tough decisions. So what should you do first?

The Great American Financial Catch-22

Here’s the thing that makes this decision so maddening: both choices seem equally urgent. Your credit card is charging you 24% interest (ouch!), but you also know that one car repair could send you spiraling back into debt faster than you can say “transmission failure.”

It’s like being stuck between a rock and a hard place, except the rock is charging interest and the hard place is your next potential emergency. But here’s a secret that might surprise you: you don’t always have to choose just one.

What Financial Experts Say (And Why It Matters)

Before we dive into strategies, let’s get something straight. The majority of financial advisors don’t recommend going all-in on just debt payoff or just emergency savings. Most suggest what I call the “hybrid approach,” and there’s solid reasoning behind it.

Dave Ramsey’s approach: Start with a $1,000 starter emergency fund, then attack debt with everything you’ve got. Only after becoming debt-free should you build a full 3-6 month emergency fund.

Other experts suggest: Build a small emergency cushion (around $500-$2,000) while simultaneously tackling high-interest debt. The exact balance depends on your debt interest rates and personal risk tolerance.

Why the difference? It comes down to psychology versus pure mathematics. Ramsey’s method works because it creates momentum, while the hybrid approach provides more security during the journey.

The Real Cost of Getting This Wrong

Let me paint you two scenarios that happen more often than you’d think:

Scenario 1: All Emergency Fund, No Debt Focus Sarah decides to build her full emergency fund first while making minimum payments on her $8,000 credit card debt at 22% interest. After two years, she’s saved $6,000, but her debt has grown to nearly $10,000. The interest she paid could have funded half her emergency fund.

Scenario 2: All Debt, No Emergency Buffer Mike throws every penny at his debt and pays it off in 18 months. But three months before becoming debt-free, his car broke down. With no emergency fund, he has to use credit cards for the $1,800 repair, essentially starting the debt cycle all over again.

Both approaches have serious flaws when taken to extremes.

Below is a chart I put together showing the difference between paying off $10,000 credit card with 22% interest versus saving the same monthly payment in an emergency fund earning 4%.

| Monthly Payment | Total Cost to Pay Off Credit Card – 22% Interest | Pay Off in Months | Amount Saved in Emergency Fund at 4% ($) | Interest Difference |

| $200 | $27,356 | 137 | $34,507 | $7151 |

| $300 | $15,596 | 52 | $16,977 | $1381 |

| $400 | $13,499 | 34 | $14,362 | $863 |

| $500 | $12,571 | 26 | $13,547 | $967 |

| $600 | $12,043 | 21 | $13,022 | $979 |

| $700 | $11,702 | 17 | $12,217 | $754 |

| $800 | $11,463 | 15 | $12,279 | $816 |

| $900 | $11,286 | 13 | $11,933 | $647 |

| $1000 | $11,148 | 12 | $12,219 | $1071 |

Even if you could pay the thousand dollars per month on your credit card, you would earn $1071 more in interest with the emergency fund if you saved the total amount and then just paid it off after 12 months.

However, you have to remember that you’ll have to make a minimum payment on your credit cards to keep them current. This will take away from the interest earnings. So what should you do?

When Debt Should Take Priority

Sometimes the math is crystal clear. You should prioritize debt repayment when:

High-Interest Debt is Eating You Alive

If you’re carrying credit card debt with interest rates above 15-20%, that’s essentially a guaranteed negative return on your money.

Think about it: even the best high-yield savings accounts are only offering around 4-5% these days. You’re losing money by prioritizing savings over debt payoff in this scenario.

You Have Stable Income and Job Security

If you’re in a secure job with predictable income, you might be able to take the calculated risk of focusing primarily on debt while maintaining just a small emergency buffer.

You Have Other Safety Nets

Maybe you have family support, excellent health insurance, or other resources you could tap in a real emergency. This doesn’t mean go without an emergency fund entirely, but it might mean you can get away with a smaller one initially.

When Emergency Savings Should Come First

On the flip side, there are situations where building your emergency fund takes precedence:

Your Job is Unstable

If you’re in a volatile industry, working as a contractor, or your company is going through layoffs, having 3-6 months of expenses saved isn’t just smart—it’s survival. I learned this lesson the hard way during the 2008 recession when “stable” jobs disappeared overnight.

You Have Dependents

Got kids? Aging parents depending on you? Your emergency fund isn’t just about you anymore. Family emergency funds need to be more robust because you’re not just covering your potential disasters.

Unexpected expenses for kids come up all the time. I remember my son jumped off the toy box, bashed his head open, and we had to get to the emergency room. After insurance, I still paid $800 out of pocket.

Your Debt is Low-Interest

If your debt is mostly student loans at 4% interest or a mortgage at 3%, it makes more sense to build your emergency fund first. These debts aren’t urgent from a pure financial standpoint.

If you have a lot of credit card debt, you’ll want to start paying that debt down ASAP, but if you just have a mortgage with a low interest rate, then consider putting more towards your emergency fund.

The Hybrid Approach: Having Your Cake and Eating It Too

Here’s where most people should land: the hybrid approach that lets you tackle both priorities simultaneously. It’s not as complicated as it sounds.

The 50-30-20 Modified Rule

Instead of the traditional 50-30-20 budgeting rule, try this when you’re dealing with both debt and emergency fund needs:

- 50%: Needs (rent, groceries, minimum debt payments)

- 20%: Debt payoff above minimums

- 20%: Emergency fund building

- 10%: Wants (because you need to live a little)

The Interest Rate Decision Tree

Here’s a simple framework to help you decide:

- If the debt interest rate is above 10%, 70% toward debt, 30% toward the emergency fund. If the debt interest rate is 7-10%: 60% toward debt, 40% toward emergency fund

- If the debt interest rate is below 7%: 40% toward debt, 60% toward emergency fund.

This isn’t perfect, but it gives you a starting point that adapts to your specific situation.

Starter Emergency Funds: Your Financial Security Blanket

Let’s talk about starter emergency funds—that initial buffer that keeps you from falling back into debt every time life happens.

Most experts recommend starting with $1,000, but I think the right amount depends on your situation:

- Single person, stable job: $1000

- Single person, variable income: $1,000-$2000

- Family with stable dual income: $2000-$3000

- Family with single/variable income: $3000

The goal isn’t to cover every possible emergency—it’s to handle the small-to-medium stuff that would otherwise derail your debt payoff progress.

Smart Strategies for the Paycheck-to-Paycheck Crowd

Living paycheck to paycheck doesn’t mean you can’t make progress on both fronts. It just means you have to be more creative:

The $20 Start

Can’t find $500 to start an emergency fund? Start with $20 a week. I know it sounds ridiculous, but here’s why it works: it builds the habit and mindset of saving, even when money is tight. Once you prove to yourself you can save $20, you’ll find ways to save $50, then $100.

With $20 a week, you can save $1000 a year plus interest. This is how I started, and when you set it up, I suggest putting it somewhere other than your normal bank. I suggest a credit union, an online savings account, or a PayPal Savings Account. These usually pay higher interest rates, too.

Automate the Tiny Amounts

Once you have your $1000 to $2000 emergency fund taken care up, set up automatic transfers of $20 per week to both your emergency fund and extra debt payments. You’ll barely notice these small amounts, but they add up faster than you think.

Use Windfalls Strategically

Tax refund? Birthday money? Work bonus? Split it 50/50 between emergency savings and debt payoff. This gives you progress on both fronts without the guilt of “choosing wrong.”

The Credit Card Emergency Trap

Here’s a question I get all the time: “Can I use credit cards instead of an emergency fund?”

Short answer: No. Longer answer: Hell no, and here’s why.

Credit cards aren’t emergency funds—they’re potential emergencies waiting to happen. What if your emergency coincides with a job loss? What if your credit gets damaged right before you need it? What if the emergency is so big that it maxes out your available credit?

I’ve seen too many people fall into this trap. They think their $5,000 credit limit is the same as $5,000 in the bank. It’s not. One is money you have; the other is money you’ll owe, with interest.

When to Break Your Own Rules

Sometimes, life throws you a curveball that requires you to break your carefully planned strategy. Here are the only times I’d recommend using your emergency fund to pay off debt:

You’re Facing Immediate Financial Catastrophe

If you’re about to lose your house or car (and you need both), sometimes using emergency savings to catch up on payments makes sense. But this should be a last resort.

You Can Replenish Quickly

If you have a guaranteed windfall coming (like a work bonus or tax refund) within 60 days, using emergency funds strategically might work. But you’d better be 100% certain about that incoming money.

The Psychology Behind the Numbers

Let’s be real for a minute: personal finance is more personal than it is finance. The “right” mathematical choice isn’t always the right psychological choice for you.

If having debt keeps you up at night, focus more heavily on debt payoff—even if it’s not the optimal mathematical choice. If the thought of no emergency buffer gives you anxiety attacks, prioritize building that safety net first.

Your mental health is worth something, and sustainable financial progress requires strategies you can stick with.

Expert-Recommended Tools and Accounts

For Emergency Funds

The best emergency fund accounts offer high interest rates, no fees, and easy access:

- Ally Bank Online Savings: Currently offering competitive rates with no minimum balance

- Marcus by Goldman Sachs: No fees, high yield, and excellent customer service

- Capital One 360 Performance Savings: Easy online management and competitive rates

For Debt Management

- YNAB (You Need A Budget): Helps you allocate money between savings and debt payoff

- Debt Payoff Planner Apps: Visualize your progress and stay motivated

- Balance Transfer Cards: For consolidating high-interest debt (if you qualify)

Building Your Personal Game Plan

Here’s how to create your emergency fund vs debt payoff strategy:

Step 1: Audit Your Situation

- List all debts with interest rates – Use this free spreadsheet to set up your debt plan

- Calculate your true monthly expenses – Use this free spreadsheet to set up your budget

- Assess your job/income stability

- Consider your personal risk tolerance

Step 2: Set Your Minimums

- Determine your starter emergency fund amount – $1000 is a good place to start

- Commit to minimum debt payments – how much do you want to pay toward debt

- Calculate what’s left for the “extra” allocations

Step 3: Create Your Split

Use the interest rate framework I mentioned earlier, but adjust based on your comfort level. If you’re naturally anxious, lean more toward emergency savings. If you’re competitive and motivated by quick wins, lean more toward debt payoff.

Step 4: Automate Everything

Set up automatic transfers so you don’t have to make this decision every month. Decision fatigue is real, and automation removes the temptation to spend that money elsewhere.

My emergency fund is set up to deposit funds every week straight from my paycheck into my account. I also set this account up at another bank to avoid looking at it. Out of sight, out of mind, it just keeps growing and growing.

Common Mistakes That Will Derail Your Progress

Perfectionism Paralysis

Don’t spend months researching the “perfect” strategy while making no progress on either front. A good plan you follow beats a perfect plan you abandon.

The All-or-Nothing Trap

Most people try to go extreme in one direction or the other. Remember: this isn’t a sprint, it’s a marathon. Sustainable progress beats dramatic gestures every time.

Ignoring Your Actual Spending

You can’t build an emergency fund or pay off debt if you don’t know where your money is going. Track your spending for at least one month before making any major financial decisions.

The Light at the End of the Tunnel

Here’s what nobody tells you about the emergency fund vs pay off debt journey: it gets easier. Much easier.

Once you have that starter emergency fund in place, every small emergency stops being a debt-creating disaster. Once you start making real progress on debt, the psychological burden lifts and you find motivation you didn’t know you had.

The goal isn’t perfection—it’s progress. And progress, even slow progress, is infinitely better than the financial stress of being unprepared for life’s inevitable curveballs.

Whether you choose to prioritize emergency savings, debt payoff, or split the difference, the most important step is the first one. Start somewhere, start today, and adjust your strategy as you learn what works for your unique situation.

Your future, financially stress-free self will thank you for taking action now, regardless of which approach you choose. Because at the end of the day, both an emergency fund and debt freedom are destinations worth reaching—and with the right strategy, you can get to both.

Ready to take control of your financial future? Start by calculating exactly how much you need for your starter emergency fund using our free calculator, then set up that first automatic transfer today. Your peace of mind is waiting.