The 50/30/20 Budget Rule: Complete Guide With Examples

Picture this: You’re sitting at your kitchen table on Sunday morning, coffee in hand, staring at a pile of bills and wondering where all your money went this month. Sound familiar? I’ve been there too, and honestly, it’s not a great feeling.

But here’s the thing – budgeting doesn’t have to feel like solving a Rubik’s cube blindfolded. The 50/30/20 budget rule is like having a GPS for your money. It’s simple, it works, and it doesn’t require a finance degree to understand.

This isn’t just another budgeting fad that’ll disappear faster than your paycheck on rent day. The 50/30/20 rule has been helping people take control of their finances for years, and today, I’m going to show you exactly how to make it work for your life.

Disclaimer: This article is for educational purposes only and doesn’t constitute financial advice. Always consult with a qualified financial advisor for personalized guidance.

What is the 50/30/20 Budget Rule? (The Basics You Need to Know)

Let me break this down in the simplest way possible. The 50/30/20 budget rule is like dividing your monthly income into three buckets:

- 50% for Needs – The stuff you absolutely can’t live without

- 30% for Wants – The fun stuff that makes life enjoyable

- 20% for Savings – Your future self will thank you for this

Think of it as the “set it and forget it” approach to personal finance. No complex spreadsheets, no tracking every single coffee purchase (though if that’s your thing, go for it).

Who Created This Brilliant System?

The 50/30/20 rule isn’t some random internet creation. It was popularized by Senator Elizabeth Warren and her daughter Amelia Warren Tyagi in their book “All Your Worth: The Ultimate Lifetime Money Plan.”

Warren, who’s spent years studying bankruptcy and financial planning, noticed that people who followed this simple formula were far less likely to find themselves in financial trouble.

Pretty smart, right?

How to Calculate Your After-Tax Income (Step One)

Before you start dividing your money into neat little percentages, you need to know exactly what you’re working with. And no, I’m not talking about that impressive number on your job offer letter.

You need your after-tax income – that’s the actual money that hits your bank account after Uncle Sam takes his cut.

Here’s what to include:

- Your take-home pay from your main job

- Side hustle income (after taxes)

- Any regular freelance earnings

- Other consistent income sources

Here’s what NOT to include:

- Your gross salary (before taxes)

- One-time bonuses (unless they’re regular)

- Money, you might get someday

Pro tip: If your income varies month to month (hello, freelancers!), take your average monthly income from the past 6-12 months. It’s not perfect, but it’s way better than guessing.

The 50% Rule: What Counts as “Needs”?

This is where things get interesting, and honestly, where most people mess up. Your “needs” aren’t everything you think you need – they’re what you actually need to survive and maintain your basic lifestyle.

True Needs Include:

- Housing costs (rent, mortgage, property taxes)

- Utilities (electricity, water, gas, basic internet)

- Groceries (actual food, not that fancy organic everything)

- Transportation (car payment, insurance, gas, or public transit)

- Minimum debt payments (student loans, credit cards, etc.)

- Basic insurance (health, car, renters/homeowners)

- Basic phone plan (yes, you need to stay connected)

The Gray Area (Be Honest Here):

- Gym membership – Need or want? Depends on your lifestyle

- Netflix subscription – Probably a want, but we’re not judging

- That premium coffee habit – A want (sorry!)

The key is being brutally honest with yourself. If you’re spending 60% of your income on “needs,” you might need to take a hard look at what’s actually necessary versus what’s just comfortable.

The 30% Sweet Spot: Making Room for Life’s Pleasures

Here’s where the 50/30/20 rule gets fun. That 30% for wants isn’t about depriving yourself – it’s about enjoying life without going broke.

Your wants bucket can include:

- Dining out and takeout

- Entertainment (movies, concerts, games)

- Shopping (clothes, gadgets, books)

- Hobbies (art supplies, sports equipment)

- Travel and vacations

- Premium subscriptions (Spotify, Netflix, that meditation app)

- Personal care (fancy skincare, salon visits)

The beauty of this system? You don’t have to feel guilty about spending money on things you enjoy. You’ve already budgeted for it!

A Quick Reality Check

If you’re spending more than 30% on wants, you might want to ask yourself: “Am I living within my means, or am I just living?” There’s a difference between enjoying life and drowning in lifestyle inflation.

The 20% Game-Changer: Building Your Financial Future

This is where the magic happens. That 20% going toward savings and debt repayment is buying your future freedom.

How to Split Your 20%:

Emergency Fund First (If you don’t have one)

- Aim for $1,000 as a starter emergency fund

- Eventually build up to 3-6 months of expenses

- Keep it in a high-yield savings account

High-Interest Debt Second

- Credit card debt (anything over 6% interest)

- Personal loans

- Pay more than the minimum whenever possible

Long-term Savings Third

- Retirement contributions (401k, IRA)

- Down payment for a house

- Investment accounts

Below is a simple example of people earning various incomes and how they would break down according to the 50/30/20 budget rule.

| Monthly Income | 20% Total | Emergency Fund | Debt Payment | Long-term Savings |

|---|---|---|---|---|

| $3,000 | $600 | $200 | $250 | $150 |

| $5,000 | $1,000 | $300 | $400 | $300 |

| $7,000 | $1,400 | $400 | $600 | $400 |

Can You Adjust the 50/30/20 Percentages? (Spoiler: Yes!)

Life isn’t one-size-fits-all, and neither is budgeting. The 50/30/20 rule is a guideline, not a financial commandment.

When You Might Need to Adjust:

High Cost of Living Areas

- Maybe it’s 60/20/20 or 55/25/20

- Focus on finding ways to reduce housing costs over time

High Debt Situations

- Consider 50/20/30 to prioritize debt payoff

- Temporary sacrifice for long-term gain

High Earners

- Maybe 40/30/30 or 45/25/30

- You have more flexibility to save aggressively

Low-Income Situations

- Start with any percentage you can manage

- Even 70/20/10 is better than no budget at all

The key is starting somewhere and adjusting as your situation improves.

Making It Work with Irregular Income (For the Freelancers and Commission-Based Workers)

Having irregular income doesn’t disqualify you from using the 50/30/20 rule. It just requires a slightly different approach.

Strategy 1: The Conservative Approach

Base your budget on your lowest expected monthly income. This way, you’re never caught off guard, and good months become bonus months.

Strategy 2: The Average Approach

Calculate your average monthly income over the past year and use that as your baseline. Set aside excess in good months to cover shortfalls in lean months.

Strategy 3: The Percentage Approach

Apply the 50/30/20 split to whatever you make each month. Consistent percentages, flexible dollar amounts.

Best Tools and Apps for 50/30/20 Budgeting

Let’s be real – doing this all by hand is about as fun as watching paint dry. Here are my top picks for making the 50/30/20 rule painless:

Free Options:

- Ally – Free PDF to help you set up your budget

- Personal Capital – Great for the big picture view

- EveryDollar – Simple, Dave Ramsey-approved budgeting

Premium Options:

- YNAB (You Need A Budget) – The gold standard for serious budgeters

- PocketGuard – Perfect for spending tracking

- Quicken Simplifi – Comprehensive financial management

Simple Calculators:

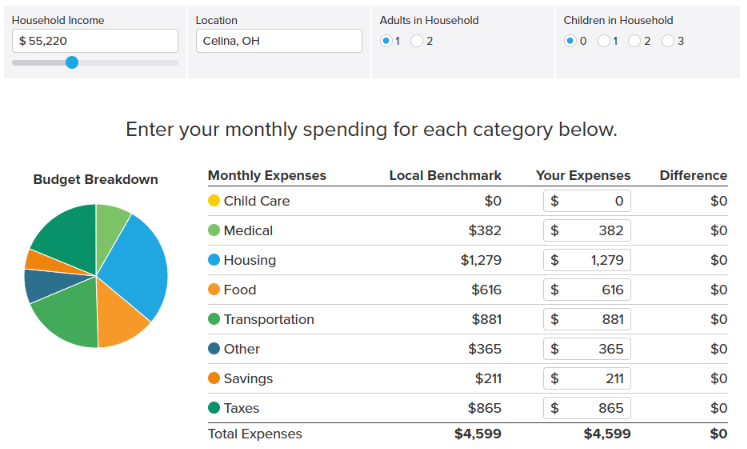

- NerdWallet 50/30/20 Calculator – Instant budget breakdown

- SmartAsset Budget Tool – Comprehensive planning features

Common Mistakes (And How to Avoid Them)

After helping countless people implement this system, I’ve seen the same mistakes over and over. Here’s how to avoid them:

Mistake 1: Being Too Rigid

The rule is a guide, not gospel. Life happens. Your car breaks down. Your cat needs emergency surgery. Don’t abandon the whole system because of one bad month.

Mistake 2: Miscategorizing Expenses

That gym membership you never use? It’s not a need just because you signed a contract. Be honest about your spending categories.

Mistake 3: Ignoring the 20%

“I’ll save more next month” is the budgeting equivalent of “I’ll start my diet on Monday.” Pay yourself first, even if it’s just $25.

Mistake 4: All-or-Nothing Thinking

Can’t save the full 20% right now? Start with 5%. Can’t stick to 30% for wants? Try 35%. Progress beats perfection every time.

The 50/30/20 Rule for Different Life Stages

College Students and New Graduates

- Focus on building good habits, even with small amounts

- Consider 60/30/10 if income is very limited

- Prioritize the emergency fund over investments initially

Young Professionals

- Classic 50/30/20 works well

- Automate everything possible

- Take advantage of employer 401k matching

Families with Kids

- May need 55/25/20 due to higher “need” expenses

- Include children’s activities in the “wants” category

- Don’t forget to save for kids’ futures too

Pre-Retirement

- Consider 40/30/30 or 45/25/30 for aggressive saving

- Focus on debt elimination

- Maximize retirement contributions

Setting Up Automation (Because Willpower is Overrated)

The secret to making any budget work isn’t having superhuman discipline – it’s removing the need for discipline altogether.

Set Up Automatic Transfers For:

- Emergency fund – $100-500/month, depending on your 20%

- Retirement accounts – At least up to the company match

- High-yield savings – For medium-term goals

- Investment accounts – For long-term wealth building

Use Separate Accounts:

- Checking – For needs and wants

- High-yield savings – For an emergency fund

- Additional savings – For specific goals

- Investment accounts – For long-term growth

[Insert image: Diagram showing money flow from paycheck to different accounts]

Tracking Your Progress (Without Becoming Obsessed)

You don’t need to track every penny, but you should check in regularly to make sure you’re on track.

Monthly Check-ins:

- Review your spending in each category

- Adjust for the following month if needed

- Celebrate wins (yes, even small ones!)

Quarterly Reviews:

- Look at your overall financial picture

- Adjust percentages if life has changed

- Set new goals for the next quarter

Annual Deep Dive:

- Review the entire year’s spending patterns

- Make major adjustments if needed

- Plan for the year ahead

What If You Can’t Save 20%? (Start Where You Are)

Let’s address the elephant in the room. Maybe you’re reading this thinking, “20% for savings? I can barely afford groceries!”

Here’s the truth: Any saving is better than no saving.

Start Small:

- 1% is infinitely better than 0%

- $25/month becomes $300/year plus interest

- Build the habit first, increase the amount later

Look for Quick Wins:

- Cancel unused subscriptions

- Cook at home more often

- Find a cheaper phone plan

- Shop generic brands

Increase Income:

- Ask for a raise

- Pick up a side hustle

- Sell stuff you don’t need

- Develop new skills for better opportunities

Remember: You’re building a muscle. Start with the weight you can handle and gradually increase over time.

Frequently Asked Questions

Does debt repayment count toward savings?

Absolutely! Paying off high-interest debt is actually one of the best “investments” you can make. A credit card with 18% interest is costing you way more than most investments will earn you.

How often should I review my budget?

Monthly check-ins are perfect. It’s often enough to catch problems early, but not so frequent that it becomes overwhelming.

What if my living expenses are very high?

Start by seeing if any “needs” can be reduced (cheaper housing, roommates, different location). If not, adjust the percentages temporarily while working toward increasing your income.

Can I use this rule if I’m living paycheck to paycheck?

Yes, but start small. Even tracking your spending and trying to save $25/month is progress. The goal is to build better financial habits.

What happens if I can’t save the full 20%?

Start with whatever you can – 5%, 10%, even 2% is better than nothing. Build the habit first, and increase the percentage as your situation improves.

Your Next Steps: Making This Work for You

Alright, we’ve covered a lot of ground here. But information without action is just entertainment. Here’s exactly what you need to do next:

This Week:

- Calculate your monthly after-tax income

- List all your current expenses

- Categorize them into needs, wants, and savings

- See how close you are to 50/30/20

This Month:

- Open a high-yield savings account if you don’t have one

- Set up automatic transfers

- Choose a budgeting app or tool

- Start tracking your spending

This Quarter:

- Build your starter emergency fund ($1,000)

- Pay off any high-interest debt

- Optimize your budget based on real spending data

- Start investing if you’re debt-free with an emergency fund

The Bottom Line: Your Money, Your Rules

Look, the 50/30/20 budget rule isn’t magic. It won’t solve every financial problem or make you rich overnight. But what it will do is give you a framework for making smart decisions with your money.

The best budget is the one you’ll follow. If 50/30/20 feels too restrictive, adjust it. If it feels too loose, tighten it up. The key is starting somewhere and being consistent.

Your financial journey is a marathon, not a sprint. There will be good months and bad months, wins and setbacks. The people who succeed aren’t the ones who never mess up – they’re the ones who get back on track quickly when they do.

So grab your calculator, open that bank account, and take the first step toward financial freedom. Your future self is counting on you.

Ready to take control of your money? Start by calculating your 50/30/20 budget breakdown today using one of the free calculators mentioned above. And hey, if you found this helpful, share it with a friend who could use some financial peace of mind, too. We’re all in this together.